As a beginning investor and newer REIA member, I haven’t had many opportunities yet to discover the potential impact of also being a National REIA and Home Depot ProXtra member. I am a homeowner though, so of course I have things that break and appliances that wear down that I have to get fixed.

As a beginning investor and newer REIA member, I haven’t had many opportunities yet to discover the potential impact of also being a National REIA and Home Depot ProXtra member. I am a homeowner though, so of course I have things that break and appliances that wear down that I have to get fixed.

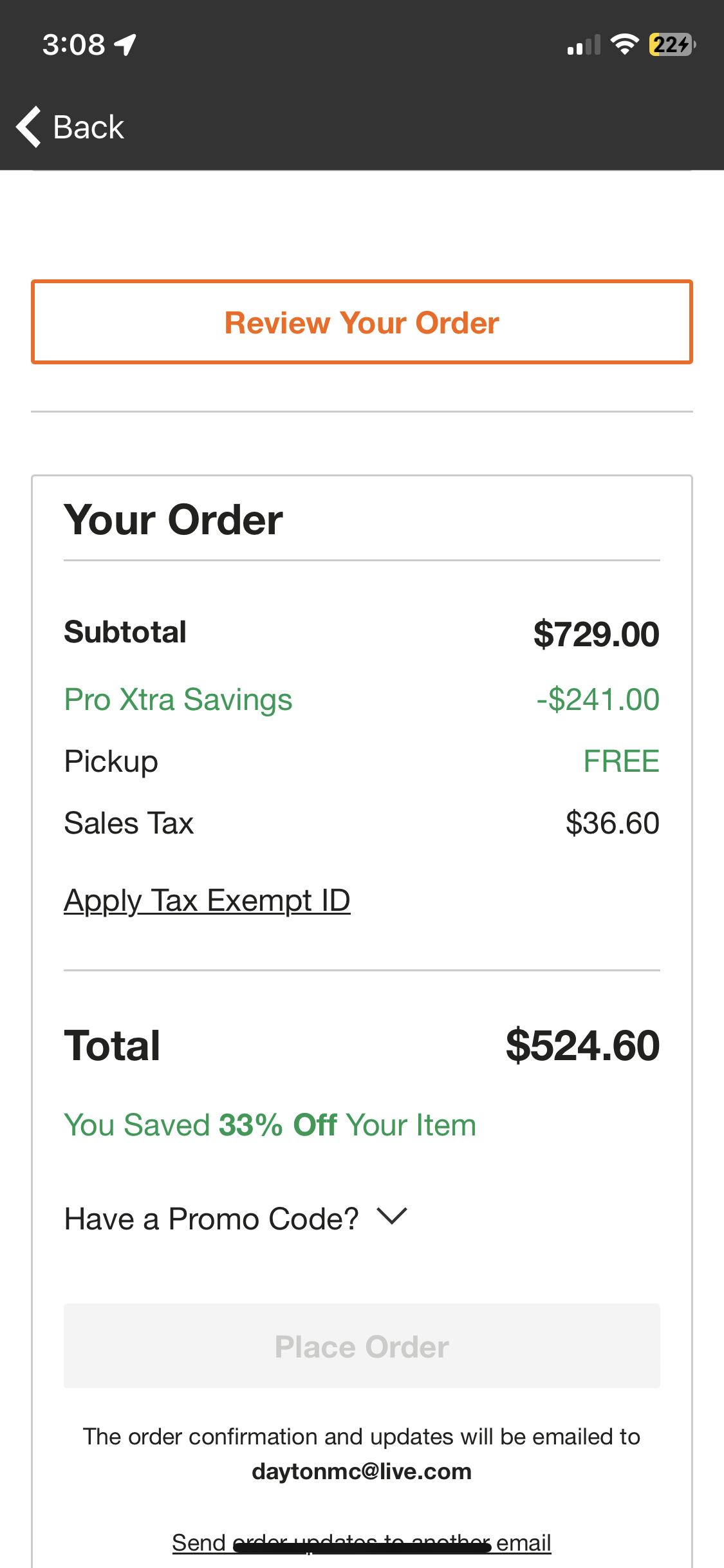

I’ll spare you all the messy details, but suffice it to say, my refrigerator recently became too much to deal with and sent me on the hunt for a replacement. I started immediately with a search on the Home Depot app, where I’m registered with my ProXtra discounts, and I wasn’t disappointed!

I didn’t need anything top of the line or anything, and with my discounts, I saved a whopping 33% off with ProXtra discount and found a solution under $500! I also checked around at some major competitors and their prices for the same refrigerator, including discounts, still came in around $50-$100 more.

Could I have gotten a used refrigerator somewhere else for less? Maybe, but who knows how much life would be left on a large, used appliance like this? Better to go new and trusted, and as both a homeowner and investor, I can really appreciate saving hundreds of dollars on my needs.

I didn’t have to anything special besides enroll and shop! Greater Dayton REIA Members can enroll quickly by downloading the Home Depot app and following the instructions .pdf found in ... Read More…